Invest 30 seconds...

...for what may lead to a life altering association!

Help Line

- +91.8800.2828.00 (IND)

- 1030-1830 Hrs IST, Mon-Sat

- support@expertsglobal.com

...for what may lead to a life altering association!

The concept of profit and loss deals with how the value of a transaction changes between cost and selling price, while interest describes the extra amount earned or paid when money is borrowed or invested over time. These two ideas form a central part of commercial arithmetic and appear often in quantitative reasoning. A solid understanding of both is an essential element of any well-designed GMAT preparation course. This page offers you a clear, subtopic-wise playlist, along with a few worked examples, to help you prepare for this concept with confidence and ease.

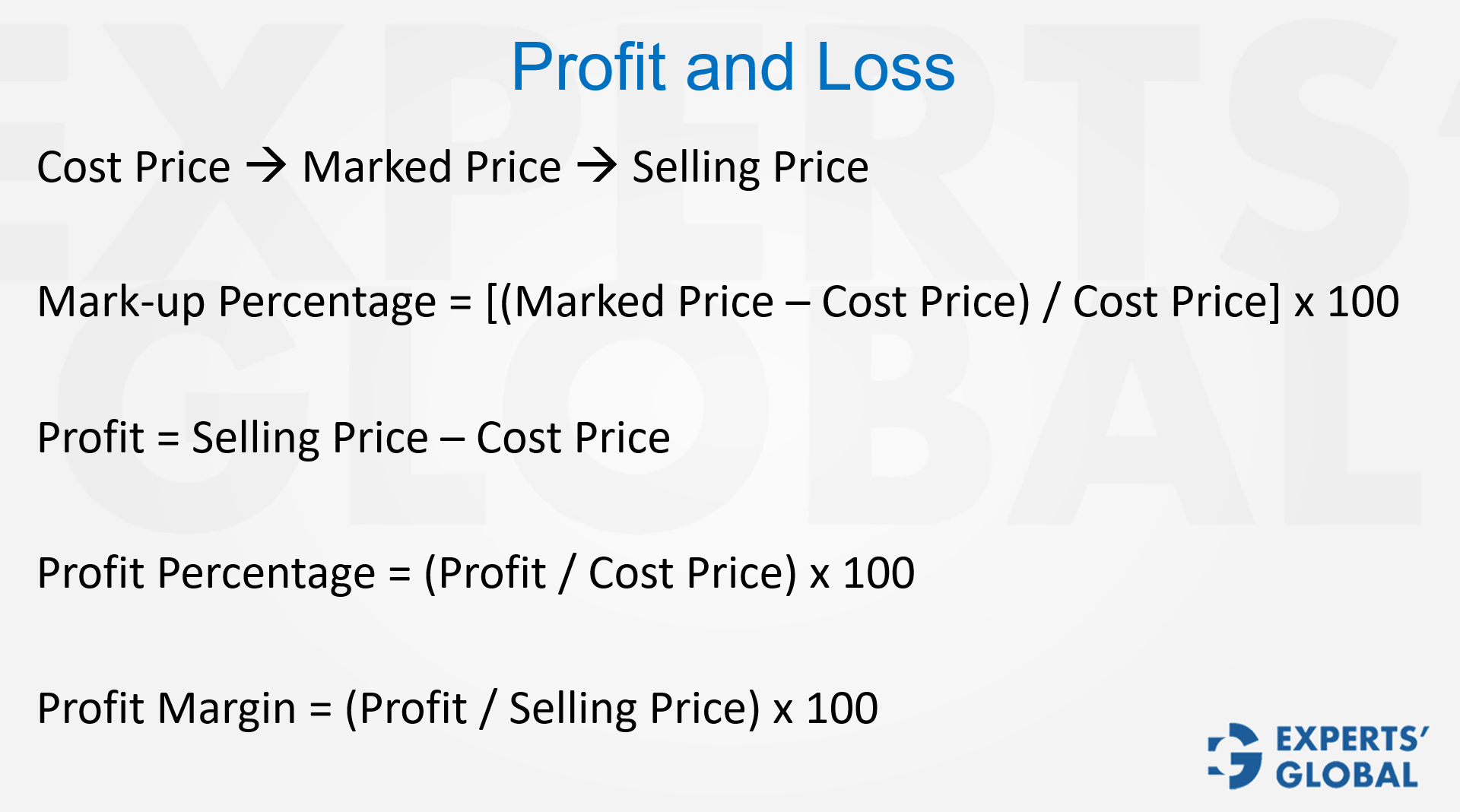

Profit and loss questions in GMAT prep often feel confusing because of the fine distinctions between terms such as cost price, marked price, selling price, profit percentage, and profit margin. At first, these ideas may seem almost the same, but their differences are very important. The cost price is the real expense borne by the seller, while the marked price is the amount printed or displayed on the product. The selling price, however, is what the buyer actually pays. Mark up percentage is always calculated on the cost price, discounts are applied to the marked price, and profit is measured from the gap between selling price and cost price. A frequent source of error is mixing up profit percentage with profit margin. The short video that follows introduces this method, walks through examples, and prepares you to apply it in GMAT drills, sectional tests, and full-length GMAT mock tests.

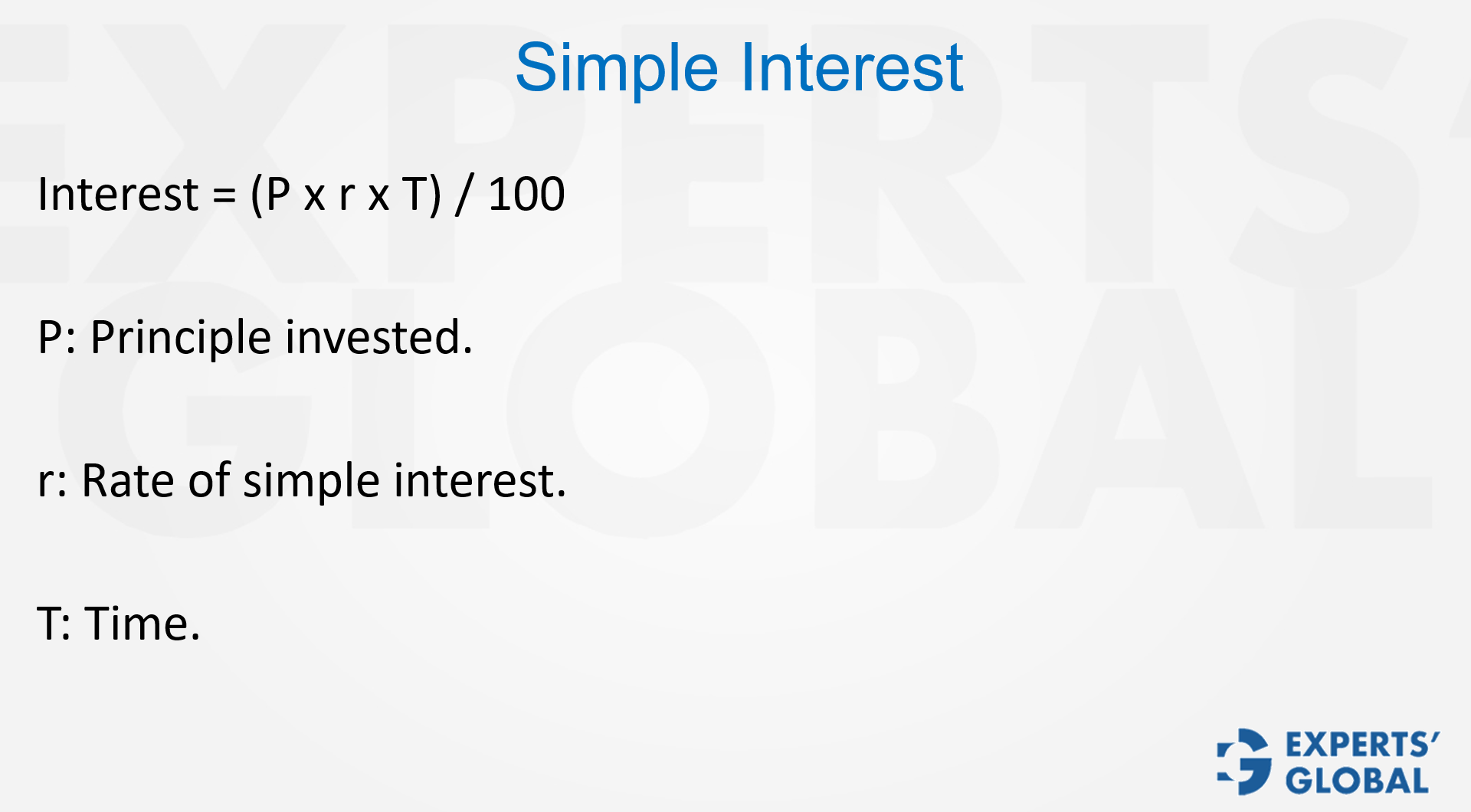

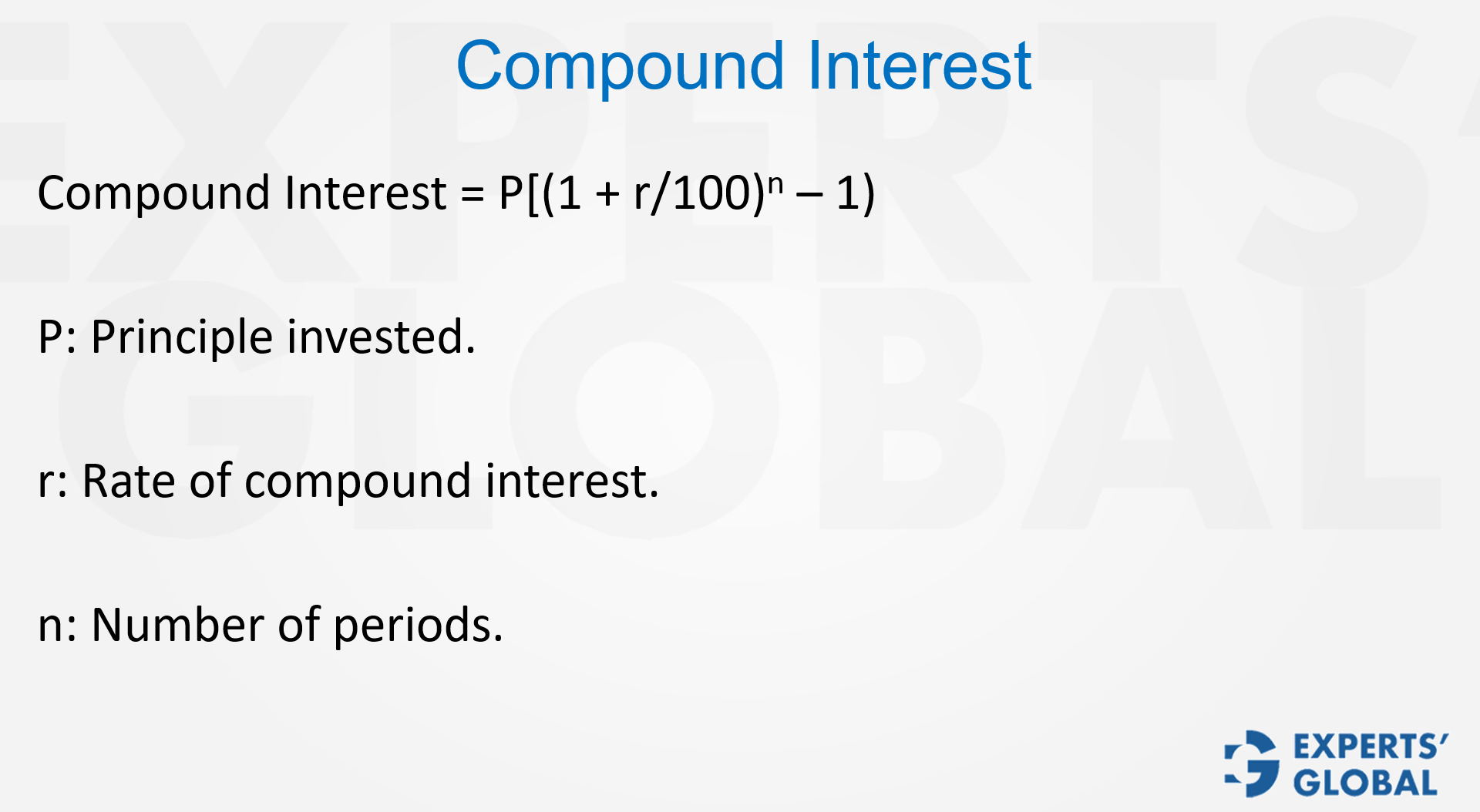

Interest based problems show up often in aptitude exams, and they measure much more than your comfort with arithmetic. They reveal how clear your concepts are and how well you can use them when the clock is ticking. The two central types are simple interest and compound interest. Although both rely on the same basic elements of principal, rate, and time, their methods of calculation and their final results differ sharply. Simple interest grows in a straight line and follows the formula (P × r × T) / 100. Compound interest grows at an increasing pace and is captured by the expression P[(1 + r/100)ⁿ – 1], where the interest is periodically added back to the principal. The real challenge lies not in memorizing these formulas, but in applying them correctly to real situations. Compounding frequency, for instance, can change the outcome significantly, as seen in semi annual or quarterly compounding. The short video that follows offers a clear explanation of this idea and shows how the GMAT may test it.

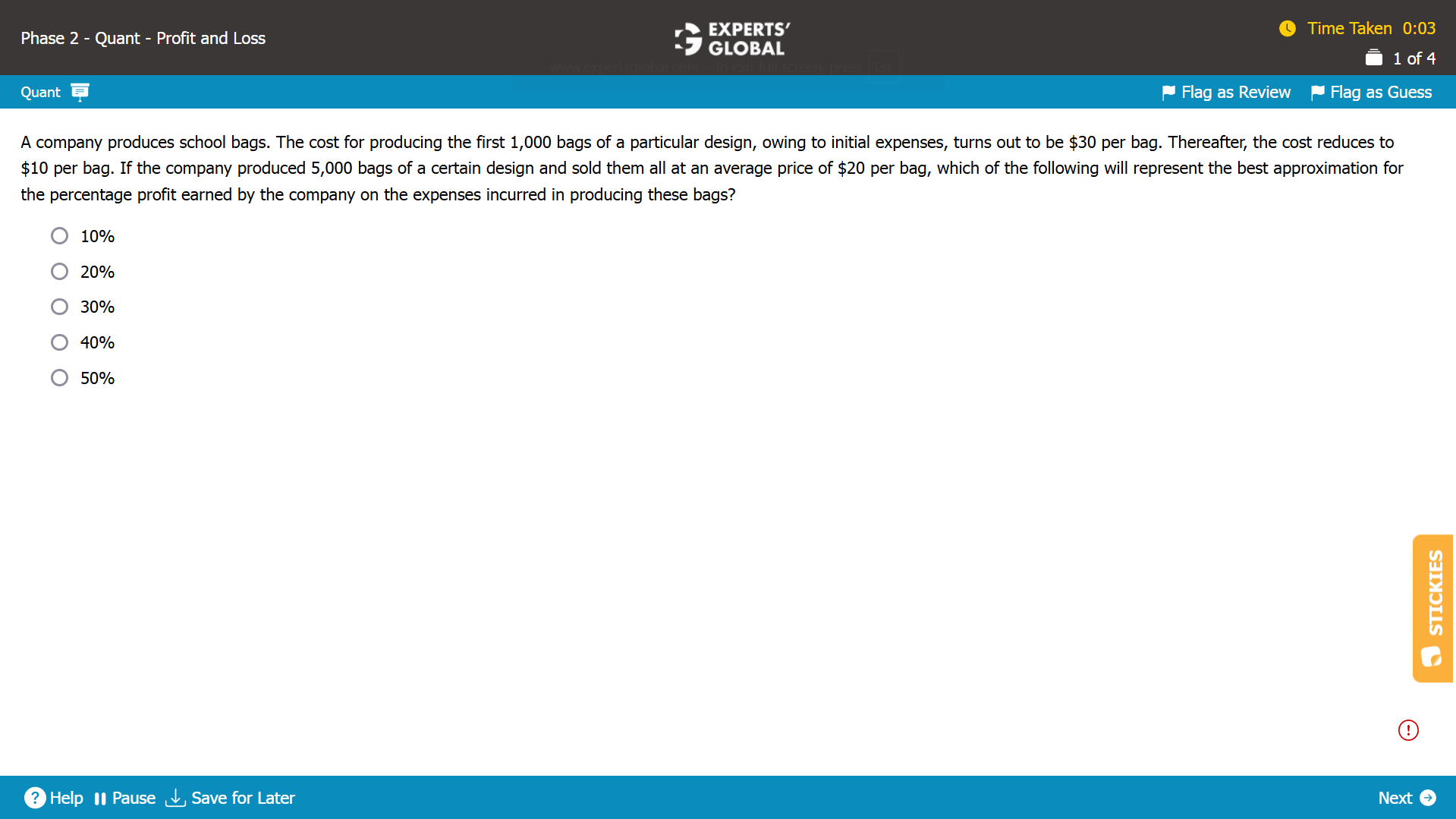

This section presents a focused practice set of GMAT-style Profit-Loss and Interest questions, each paired with a carefully structured explanation. Work through every item at a calm, deliberate pace, using the methods and ideas that you have just studied on this page for handling Profit-Loss and Interest questions on the GMAT. At this stage, give priority to applying the systematic approach accurately rather than only aiming for a correct response. After attempting each question, click on the explanation control to verify the right answer and to review the full stepwise reasoning behind it.

Show Explanation

Written Explanation

Cost for the first 1,000 bags = $30 x 1,000 = $30,000

Cost for producing the next 4,000 bags = $10 x 4,000 = $40,000

Total cost = $70,000

Revenue = $20 x 5,000 = $100,000

Gross profit = $100,000 – 70,000 = $30,000

Percentage profit = (30,000/70,000) * 100 =~42%.

Hence, D is the correct answer choice.

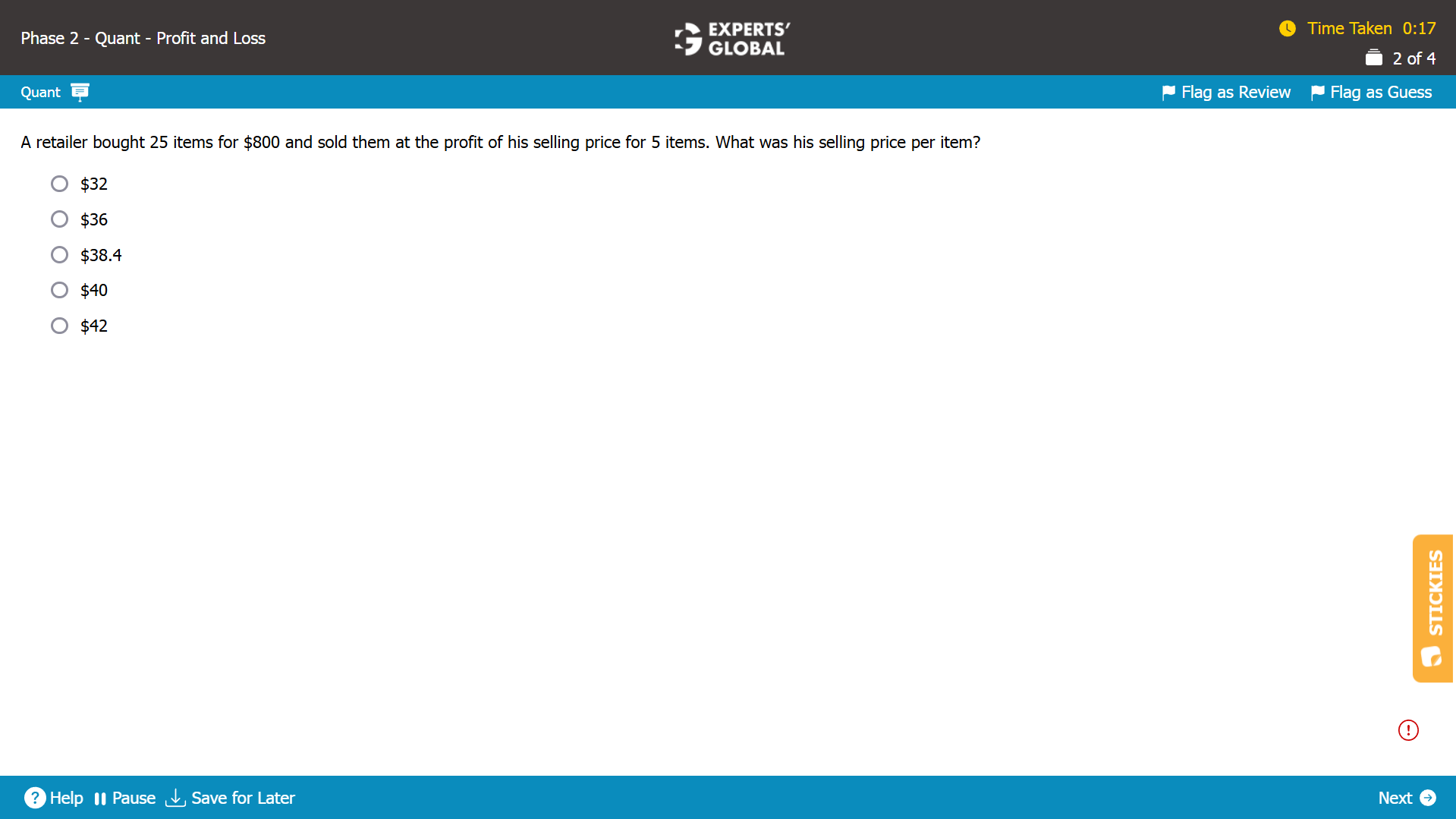

Show Explanation

Written Explanation

Let’s say that the selling price per item was x.

Profit = Selling price of 5 items = 5x.

Cost of purchasing 25 items = $800.

Selling price 25 items = cost of purchasing 25 items + profit

25x = 800 + 5x

5x = 800

x = 40

So, the selling price per item was $40.

D is the correct answer choice.

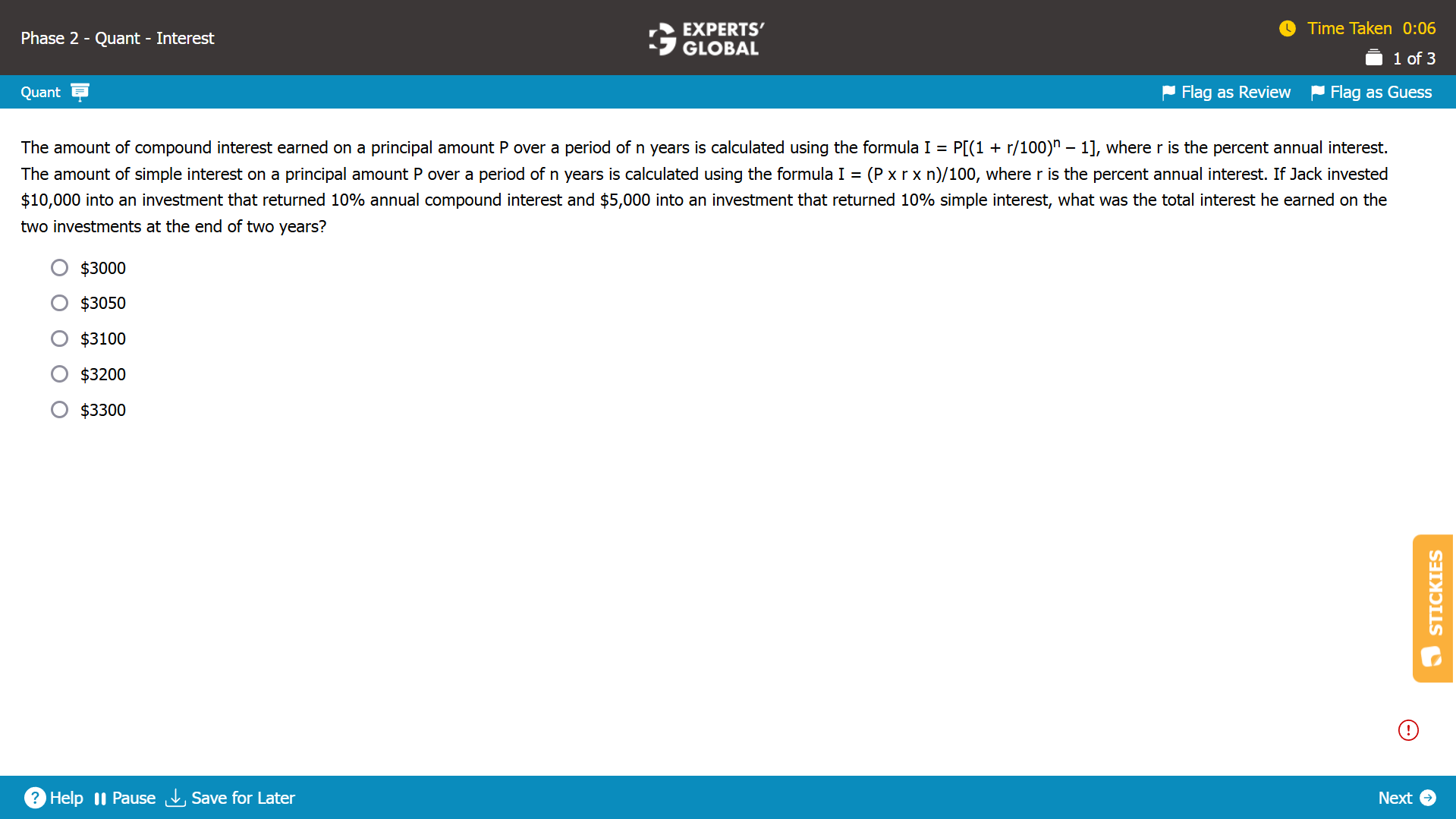

Show Explanation

Written Explanation

Investment 1…

Principal = $10,000

Compound interest rate = 10%

Period = 2 years

Compound interest earned = P X [(1 + r / 100)n – 1] = 10000 X [(1 + 10 /100)2 – 1] = 10000 X [1.21 – 1] = $2100.

Investment 2…

Principal = $5,000

Simple interest rate = 10%

Period = 2 years

Simple interest earned = (P x r x n)/100 = (5000 X 10 X 2) / 100 = $1000.

Total interest earned = 2100 + 1000 = $3100.

C is the correct answer choice.

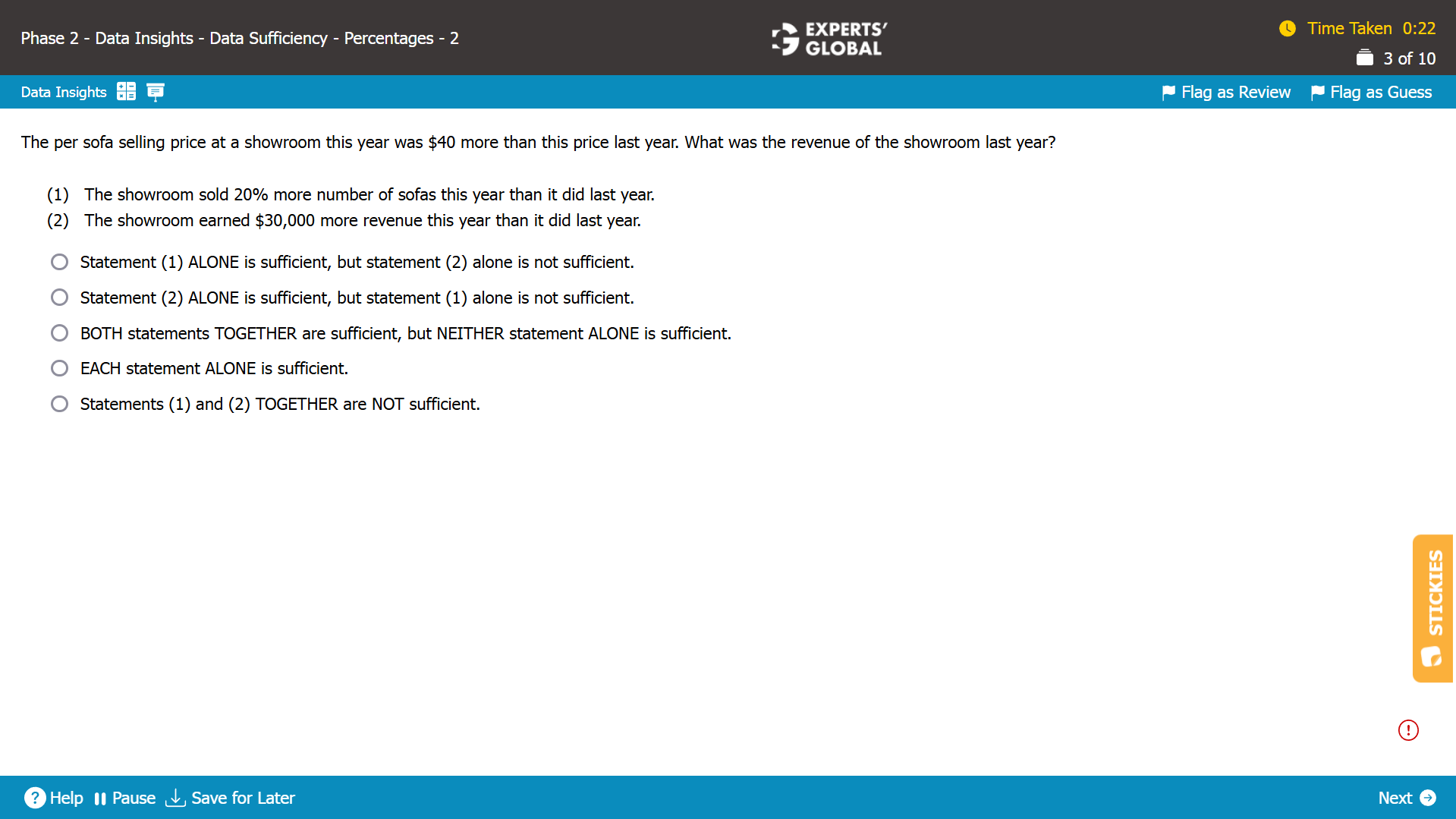

Show Explanation

Written Explanation

Let’s say the showroom sold ‘s’ sofas for ‘p’ average price last year. This year, they sold ‘s2’ sofas for ‘p+40’ average price. We need the value of s*p.

Statement (1):

s2 = 1.2*s. But there is no mention of the price of sofa, this year or last year. s*p cannot be calculated. Insufficient.

Statement (2):

s2*(p+40) = s*p + 30,000. s*p cannot be calculated. Insufficient.

Combining both.

s2*(p+40) = s*p + 30,000 and s2 = 1.2*s.

1.2*s*(p+40) = s*p + 30,000.

s*p = 150,000 – 240*s. Insufficient.

Hence, E is the correct answer choice.

High quality Profit-Loss and Interest questions are not available in very large numbers. Among the limited but genuinely strong resources are the official practice materials released by GMAC and the Experts’ Global GMAT course. Within the Experts’ Global GMAT online preparation course, every Profit-Loss and Interest problem appears on an exact GMAT like user interface that includes all the real exam tools and features. You solve more than 40 Profit-Loss and Interest questions in quizzes and also take 15 full-length GMAT mock tests that include several Profit-Loss and Interest questions in approximately the same distribution and proportion in which they appear on the actual GMAT.

All the best!